December 14, 2021 | Forex Brokers

In order to trade the Volatility 75 Index, you need a high quality broker that offers the VIX among its trading assets. We have gathered a list of the best Volatility 75 Index brokers that accept traders from South Africa and most other countries.

1) IC Markets - MT4 & MT5 trading symbol: VIX

2) Pepperstone - MT4 & MT5 trading symbol: VIX

3) Hot Forex - MT4 & MT5 trading symbol: VIX.F

4) IFC Markets - MT4 & MT5 trading symbol: USVIX

5) Ava Trade - MT4 & MT5 trading symbol: VXXB (This trading asset is not directly the Volatility 75 Index, but an ETN created to track the performance of the VIX, so it should make no real difference for traders)

All the above listed brokers are among the largest brokers in the world, and they have at least a B+ rating. You can check their individual rating in our forex brokers ranking section.

The Volatility 75 Index, also known as the VIX, is a stock market index administered by the Chicago Board Options Exchange, currently known as CBOE, which measures the stock market's expectation for volatility over the next 30 days based on S&P 500 option pricing. Volatility refers to a statistical measure of how much the price of an asset moves in either direction. It is frequently used to assess the riskiness of an asset or security.

The VIX, which was launched in 1993, is commonly called the "fear index" because traders and investors can use it to evaluate market emotion and determine how fearful or uncertain the market is. The higher the VIX, the more volatile the market is likely to be.

Volatility is predicted to be minimal while the VIX is at level 5. Trading with low volatility is difficult. At the same time, a Volatility Index level of 5 means the market is in a very low risk mode. During calm periods of the market, option premiums are small and narrow, making it impossible to sell options far from the current stock price. If you're a trader, what are you going to do in such a time? It is essential to be active and keep your position size small, but you don't want to push deals into the market that aren’t appropriate.

The Volatility Index, abbreviated as VIX, is an index that measures the volatility of the S&P 500 stock index. The Volatility Index (VIX) is a measure of market fear, and if the VIX value is greater than 30, the market is in the fear zone. Essentially, the larger the value, the greater the fear. When the VIX is less than 30, it indicates a level of security. And, the lower the VIX level, the higher the complacency. The Volatility 75 Index is an excellent tool for traders looking to trade market volatility or as a quick hedge during times of market instability.

There is no unique method for the Volatility 75 Index that you need to follow. Trading Volatility 75 follows the same pattern as trading currency pairs. Volatility 75 trading relies heavily on the following rules, just like currency pairs:

1. Support and Resistance

2. Price Action

3. Market Structure

You can start your analysis of the Volatility 75 Index with the daily chart. Analyzing from a daily chart allows you to grasp market structure better. It's advisable to research the market using a line chart before placing trades using a candlestick chart.

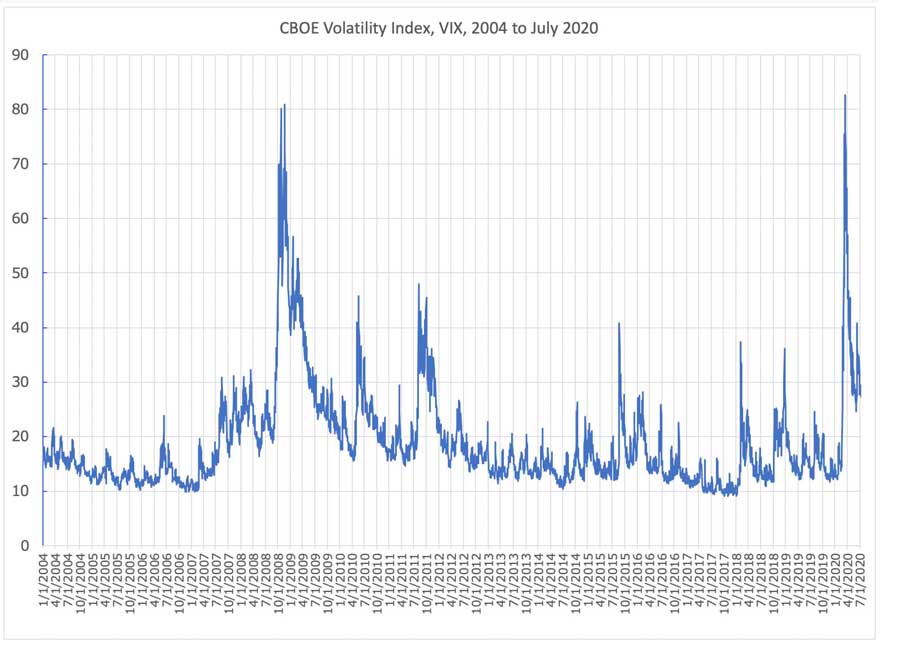

Figure 1: Chart of the Volatility 75 Index between 2004 and 2020

You can use the line chart to understand support and resistance by focusing on the closing price. Once you've identified the major and minor support and resistance levels on a daily basis, you can use a lower time frame to identify an ideal entry position for your trade.

Here are some simple rules for Volatility 75 trading:

1. Avoid consolidation or range bound markets.

2. Keep an eye out for the Supply Zone, both on the 4 hour and 1 hour time frames.

3. Always employ an appropriate risk management plan.

4. Don't place any trades if you don't know the market trend.

5. Volatility moves in a zigzag pattern, so if you notice the formation of a 'W' or 'M' based on market structure, you can profit from it.

Don't expect to make much profit in your first week of trading Volatility 75, but if you are consistent, you can start making insane profits. The only thing you need is to develop a strategy, test it on the demo, modify it, and then apply it to your real account.

Volatility is typically defined by quick change and unpredictability, and this description holds true in the investment sector. Market volatility is a statistical measure of the difference between possible returns for a given market index. In other words, market volatility is a measure of the value fluctuations that a market undergoes over a certain period. When a market is deemed very volatile, it is frequently unpredictable and has substantial price variations. A highly volatile market is associated with significant risk due to its unpredictability and should be cautiously approached. High market volatility is commonly associated with economic hardship, and low market volatility is often associated with economic growth.

Economic issues frequently influence market volatility. Economic news, interest rate changes, and fiscal policy are topics that appear to routinely affect market volatility. Political developments have recently been a driving force. Because volatility reflects investors' emotions, every factor that might impact investor behavior will affect market volatility. In general, a market is not considered volatile unless it fluctuates by more than 1% over a sustained period.

Market volatility is an excellent predictor of the market's state and general investor sentiment. A highly volatile market is characterized by huge swings in value, whereas a less volatile market has more consistent returns. Volatile markets can be driven by a number of external variables, such as macroeconomic news and political change. Regardless of the source, volatile markets convey unpredictability and uncertain investor mood. Many investors look to a market volatility index to gain a sense of how risky the market is overall. The CBOE volatility index, which forecasts future volatility using S&P 500 index options, is a popular market volatility index. At the end of the day, volatility is an excellent measure of market risk, and keeping an eye on it is critical when selecting how to manage an investment portfolio.

The best time to trade VIX 75 is typically when V75 traders should wait to generate a steady profit. Many traders start trading positions at the wrong time, which frequently results in account loss, eventually barren the account balance.

Professional traders win their trades most of the time when they trade at the correct time, with the right trading talent, patience, and a positive frame of mind. Successful Volatility Index 75 traders do not always enter trades. In addition, the best Volatility Index 75 trades are often made at the point of breakouts or reversals. Some candlestick patterns might also indicate the best time to enter profitable trades. Engulfing Candle bars, pin bars, and other candlestick patterns fall into this category.

Technically, the price of the Volatility Index 75 forms support and resistance on all time frames. When price reacts to previous support or resistance levels, this is the best time to trade Volatility Index 75. Reactions such as trend continuation, price reversal, or retest and bounce off support, and resistance levels are also crucial. Fundamentally, the Volatility Index 75 is unaffected by the news. V75 price, on the other hand, has a positive correlation with the USD Index (DXY) and several USD-based Forex pairings, such as USDJPY. Sometimes, XAUUSD or Gold has a negative correlation with V75.

The timing of price movement or consolidation breakout happens around the following time:

· 03:00 GMT

· 07:00 GMT

· 11:00 GMT

· 15:00 GMT

· 19:00 GMT

· 23:00 GMT

The most critical times are 11:00 and 23:00 GMT.

There is a possibility of occasional ranging or consolidating price movement, but this happens occasionally.

Pro traders with sharpshooter skills typically enter trades between 11:00 and 23:00 GMT.

A record-breaking high of 82.69 was set in March 2020, when the COVID-19 epidemic took hold, and its effect on the economy was still unknown. When the global financial crisis demolished the markets in the fall of 2008, this peak eclipsed its previous high of 80.86. Most of the time, the VIX has hovered between 10 and 30 for the vast majority of its life.

When the VIX is between 13 and 19, it's considered normal, and the volatility over the following 30 days should be the same when it's in this range.

Volatility 75 is a good asset to trade since it's easier to predict price movements, which means it's easier to profit than other assets like Forex and stocks.

The strategy I am discussing for trading Volatility 75 is the simplest yet powerful and most profitable strategy for trading V75. It is applicable even if you are inexperienced in trading. You won't become a millionaire overnight. However, with proper risk management, your account can grow consistently. Consider using a small lot size of 0.01 if you have at least $500 in your account.

This strategy has an 80% success record, and we only trade in one direction, which is always a buy. These are the indicators you'll require:

· Simple Moving Average (14 Period)

· Stochastics Oscillator (14, 3, 3)

· ATR Oscillator (14 Periods)

You will execute trades using two timeframes (4 Hour and 30 Minutes)

1. Keep an eye out for a new bullish H4 Candle to cross above the moving average below.

2. Now, switch to the 30-minute timeframe and check for stochastics to enter oversold territory. Before entering a buy, move below the 30 level and then back above it.

3. Create a buy position and set a stop loss equal to two times the current ATR value on the 30-minute timeframe.

4. When the H4 stochastic falls below the overbought threshold of 80, close your profits.

That's it. It's so basic, yet it's very effective. You are now prepared to begin trading Volatility 75.

► Best Forex Brokers for Large Accounts

Choosing a forex broker can be a very daunting task because the number of available options is overwhelming. With so many brokers advertising themselves as being the best, people go to specialized websites to read reviews and see broker rankings hoping they will find which broker is their best choice... Read More

► Largest Forex Brokers in The World by Volume

A lot of traders think that a big broker is better than a smaller one because a larger company has many advantages such as economies of scale, a better liquidity position and is the subject of higher scrutiny from the public and the regulators. While this basic assumption has some merit... Read More

Since there is a lot of confusion among retail traders about the overall quality of forex brokers, we have decided to create an advanced rating system and evaluate all the major forex brokers in the world according to the same set of criteria. Because we are aware that it is impossible to evaluate all forex brokers... Read More

1. CBOE (Chicago Board Options Exchange)

2. S&P 500 (The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities)